Welcome to Water Cooler Wellness

Here we are, a little more than two weeks into the New Year, and — hopefully — most people are still sticking to the changes they vowed to make in 2014. Take a look at What’s Up, USANA? for example. Surely you noticed a change (or should I say improvement) to the look and feel of the blog, right? You can thank Tim and Jessica — the social media masters — for that. As always, they’ve committed to making our content even better than before so that you get the most out of your time here.

Here we are, a little more than two weeks into the New Year, and — hopefully — most people are still sticking to the changes they vowed to make in 2014. Take a look at What’s Up, USANA? for example. Surely you noticed a change (or should I say improvement) to the look and feel of the blog, right? You can thank Tim and Jessica — the social media masters — for that. As always, they’ve committed to making our content even better than before so that you get the most out of your time here.

It’s not just the look of What’s Up, USANA? that’s changing though. We’re also adding some new series, including this one! I’m super excited about it, because I’ll be informing all of our trusty readers exactly what we’re doing at the home office to improve the health and wellness of our employees. And you know what’s great about that? You can take these wellness lessons and apply them to your own life. At least that’s my hope for this blog series that I’m naming “Water Cooler Wellness.” You know … like casually chatting about life around the water cooler at work. That’s still a thing, isn’t it?

Our First Order of Business

Before we delve into the first wellness topic, I should mention that USANA’s Wellness coordinator Lauren Reichman will be the brains behind this operation. After all, my brain’s only equipped to understand simple “writer things” like typing, spelling, and, you know, other stuff with words.

Lauren was smart enough to assign a different health and wellness topic to each month of 2014, applying different activities that correlate with the month’s theme and making it super convenient to write this monthly series.

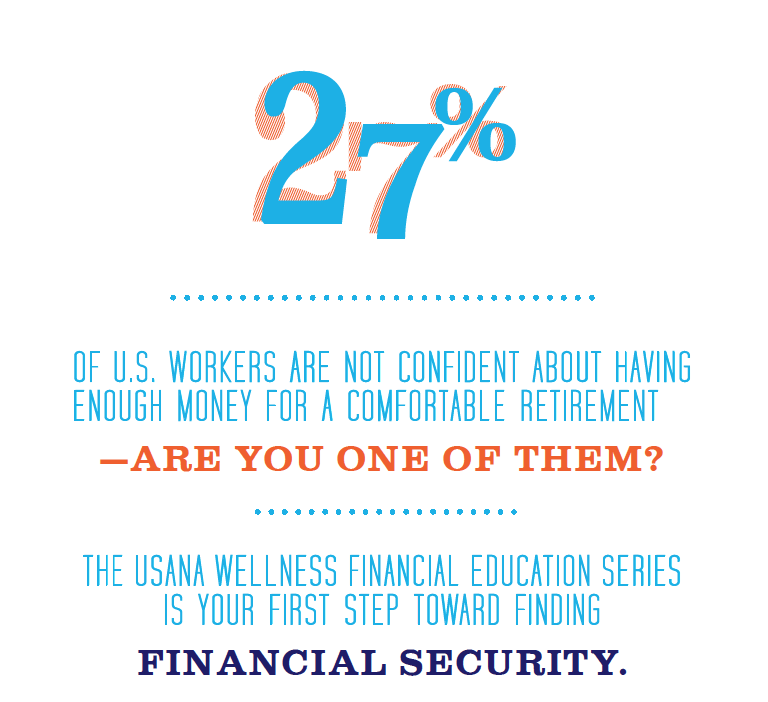

For January, Lauren’s helping our employees by tackling the tricky subjects of budgeting and personal finances. It’s something almost everyone needs guidance in, and it plays a huge part in our overall wellness.

For January, Lauren’s helping our employees by tackling the tricky subjects of budgeting and personal finances. It’s something almost everyone needs guidance in, and it plays a huge part in our overall wellness.

I’m sure you were probably expecting some healthy exercise or eating tips, but she’s really trying to focus on an overall wellness experience. And my current bank statement filled with random fast food and online shopping purchases proves that financial ignorance certainly leads to unhealthy life choices.

Educate Yourself

In order to get the irresponsible spenders such as myself back on track, USANA’s lined up a new financial education series for the home office employees. The series will cover eight pillars of financial wellness, and some of the tips include:

- Establish a financial confidence account that you promise not to touch unless an unexpected issue arises. This can be a hard one to practice, but it will totally come in handy when you run into a financial downpour on that unexpected rainy day.

- Analyze your personal debt and credit. Are you spending money on certain items that aren’t necessary, and is that spending slowly burying you under a mound of unwanted debt? It’s time to get real and figure out where you can cut unacceptable spending.

We can talk all day about saving, budgeting, and proper spending, but what about raking in the cash? One pillar of the financial series focuses entirely on increasing your cash flow by determining opportunities for multiple income sources. You might be passing up moneymaking opportunities without even knowing it.

We can talk all day about saving, budgeting, and proper spending, but what about raking in the cash? One pillar of the financial series focuses entirely on increasing your cash flow by determining opportunities for multiple income sources. You might be passing up moneymaking opportunities without even knowing it.- Write up a list of your top 10 values in life. It might include family, health, hobbies, or anything else that’s important to you. Now take a look at your bank statement and see how many of your purchases are directly related to those values. This is a great way to prioritize your spending by recognizing where you’re wasting money.

- A big takeaway from the financial series is that we learn how to handle our money the way our parents did. Their actions and spending behavior shape the way we end up handling our finances. So think about what situation your parents are in currently. Subconsciously, you might be mimicking their mistakes, so analyze what they may have done right or wrong, and use that as an example of what works and what doesn’t.

- Often when people think about someone who’s rich, they picture fancy homes, luxury vehicles, and expensive clothing. They’re correlating wealth with stuff, and this creates a false impression of happiness. Even someone living on a low-income salary can still be wealthy. Remember to live within your budget, create valuable relationships, and make purchases that boost your personal development in order to lead a truly happy, wealthy life.

That’s only a small taste of what the financial series covers. I wish I had some more specific tips for you guys, but my first course begins next week, so I still consider myself a total budgeting newbie. In the meantime, I’m getting a head start by breaking down my checking account to decide what areas include wasteful spending and how much money I should be setting aside for savings each month.

I hope this encourages each of you to do the same and to take a closer look at your financial life. No matter how much money we make, we’re always going to want more, so the key is to create a financial plan that can become a lifestyle you feel happy and healthy about. Go ahead and get started by checking out the eight pillars website!

We’ll have more on financial planning in the coming weeks. Make sure to subscribe to What’s Up, USANA? for all the latest information.

Water Cooler Wellness is a USANA series looking at ways entrepreneurs or everyday folks can get healthy — physically, financially and maybe even emotionally. Next month in Water Cooler Wellness: Heart Health

We’re proud to bring you the freshest content on the web! Follow USANA on Twitter, like our USANA Facebook page and enjoy the latest videos on the official USANA YouTube channel.

Learn what USANA is doing to make the world a better place.

Learn what USANA is doing to make the world a better place.

The future of personalized health and nutrition is now available with USANA’s True Health Assessment.

I am really excited about this series. I know that between Nick and Lauren they will provide What’s Up, USANA? readers with awesome information on physical and financial wellness. Nice way to kick it off, Nick!